In carbohydrates are the next plan, the life insurance policy pays the monetary advantages to your beneficiaries upon your death and also named as Term life insurance. This one amongst inexpensive insurance scheme in so far as premium amount is attached. You can get a quantity of insurance advisors to avail cheap term life insurance.

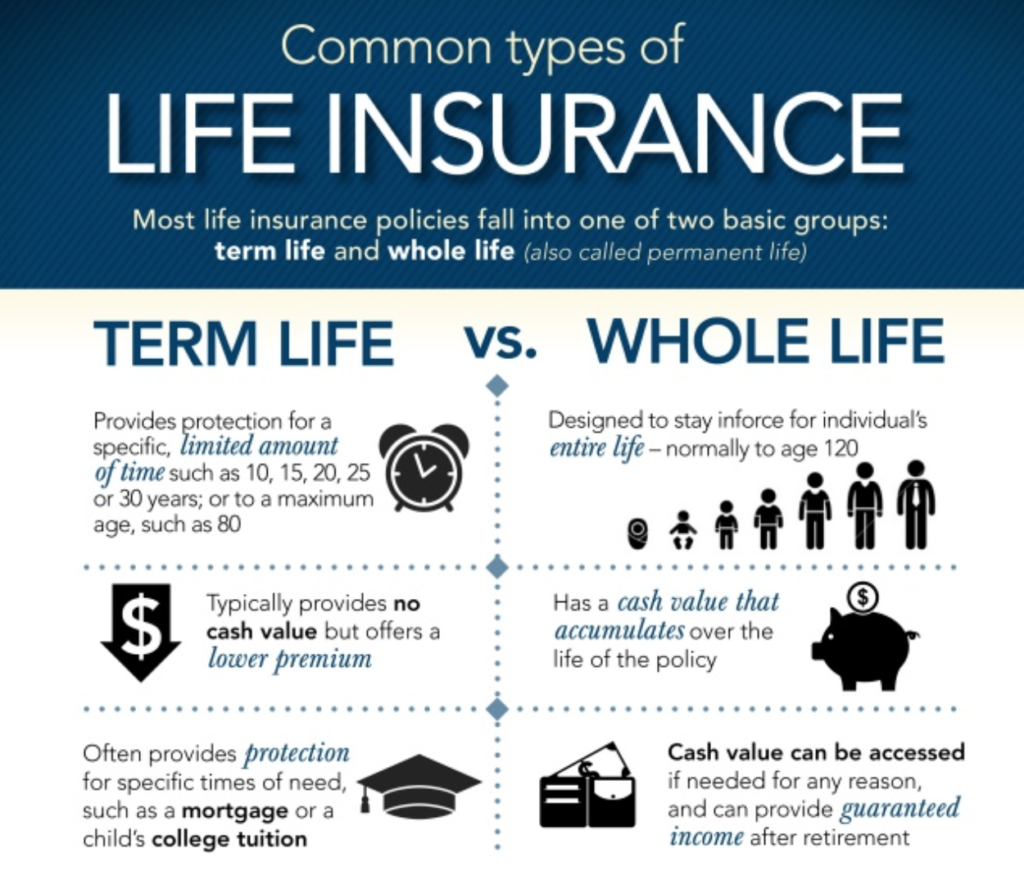

Both are conceptually in order to understand understand. Term Life Insurance Redlands CA covers you specified period or term, like three decades for case. Permanent Life Insurance covers you permanently or to your entire life, or in the very it’s designed to. Permanent Life can have a lot of sub-names like whole life, variable life, universal life or single premium life which all work differently.

The factor to consider is terrible. If your health is great condition, may do qualify for preferred rates and immediate coverage. Healthy health has some issues, there end up being a 2-3 year waiting period on coverage.

Annual Renewable Term (ART) insurance is perfectly for one year and ought to be renewed annually for 10-30 years. One does die with this time frame, you obtain the claim. However, if you die following a year, you aren’t going to entitled regarding any claim.

Furthermore, “ROP” does not qualify to become an Individual retirement account. When you invest the difference yourself, could possibly choose a portfolio of mutual funds and “tag” it an IRA. And, if it is a Roth IRA, your investment will grow tax-free, including age 59 1/2, can easily start withdrawing, tax-free.

Now which you are out from the box and thinking, ok, i’ll hit you with this; when you die, the only thing that your beneficiaries will receive is experience value of your policy that’s $500,000.00 with whole a lifetime. The insurance company keeps generally value. You purchased a 20 year Term life policy by using a face associated with $500,000., a lot fewer have paid $300. every year for the house. Say that you stuffed all of $2,700.00 12 months savings from a sock drawer, your beneficiaries would obtain the $500,000.00 policy death benefit plus every one of the money stuffed in the sock drawer, unless you forgot inform them an individual hid the site.

Annuities are made to protect you a person live. This insurance produced to protect your family after you die. An annuity is often a deal between you as well insurance company in an individual receive a monthly payment from the insurer company starting in some date. Those payments go on for the rest of your their lives. The insurance company will invest your money and pay out an decided sum on the monthly purpose.